Save MI City : Reinvesting In Our Cities

By Sara E. Teller

MICHIGAN HAS the worst record in the nation for investing in local communities. Limiting funding at the state level greatly limits the ability of local governments to invest in the services needed to keep cities thriving. SaveMICity is an informational campaign of the Michigan Municipal League with the purpose of helping cities understand and reform municipal finance at the state level. The organization’s site boldly states, “The past is over, but we can create a new day, a new trajectory that will result in true economic growth.”

After years of working within the existing paradigms, Michigan Municipal League is undertaking a major  legislative and policy push aimed at reforming the way finances are being handled with the direct purpose of encouraging renewed investment in communities. “The theme is that local units shouldn’t just be surviving, they should be thriving,” says Sheryl Stubblefield, Finance Director for the City of Ferndale. The League will be developing policy recommendations specifically around three themes: Cost Containment, Revenue Enhancement, and Structure of Government.

legislative and policy push aimed at reforming the way finances are being handled with the direct purpose of encouraging renewed investment in communities. “The theme is that local units shouldn’t just be surviving, they should be thriving,” says Sheryl Stubblefield, Finance Director for the City of Ferndale. The League will be developing policy recommendations specifically around three themes: Cost Containment, Revenue Enhancement, and Structure of Government.

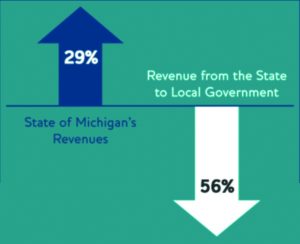

In partnership with the cities of Pleasant Ridge, Berkley, Ferndale, Oak Park, and Hazel Park, SaveMICity presentations are being conducted by the Michigan Municipal League throughout the month of August. Participants will find out why, as Michigan’s economy is recovering from the Great Recession, local communities continue to struggle financially. One of the major themes of the presentations is how Michigan has disinvested in local governments. “A major source of revenues for the local units is revenue-sharing from the state, and that continues to decline,” Stubblefield explains. Other themes include how the state is not appropriating funds to the local units, but diverting it to its own budget instead, and how the property tax system is broken. By using potential local funding for the statewide resources, local governments are left struggling.

“The way the Headlee Override and Proposal A have been set up, they are not working together,” Stubblefield claims, “The system was designed to cap tax growth, with no consideration for declines in tax revenues. There is no fix in the system for when property values dip as low as they have in the past ten years. Taxable values can only grow at the rate of inflation, as will the expenditures. There is no tool to get the taxes collected to where they were pre-recession. Local communities will never be able to catch up.”

SaveMICity presenters argue that current policies aimed at cutting costs and lowering services provided simply isn’t the answer. “As we systematically disinvest in our local communities, we are making our communities less attractive for people. If people don’t move to our communities, or as has been happening,  move out of our communities and out of our state, we begin this downward spiral, that will be nearly impossible to recover from,” Stubblefield explains. Basically, the less communities are able to offer residents and those visiting, the less likely they are to remain populated, and the less revenue the cities generate in the long run. It’s a vicious cycle.

move out of our communities and out of our state, we begin this downward spiral, that will be nearly impossible to recover from,” Stubblefield explains. Basically, the less communities are able to offer residents and those visiting, the less likely they are to remain populated, and the less revenue the cities generate in the long run. It’s a vicious cycle.

“We should be investing in our cities, providing communities with amenities that taxpayers are willing to support and utilize so we can create thriving communities. Increasing the tax base which will increase the tax revenues,” Stubblefield adds. If the appropriate services are provided and cities are kept desirable to live in, this will attract more residents and increase revenue. It’s a win-win.

Presenters also detail the need for tax reform at the state level. “We need informed legislators who understand the issues facing local governments and have the ability to give the local units more tools to increase investment in local communities,” says Stubblefield. The League says the answer is increasing revenues, not lowering expenditures, since local units are already operating effectively on very limited budgets. Communities need assistance from the state to continue providing desirable areas for residents to live and work. “More residents equals a higher tax base which translates to more revenues,” Stubblefield adds.

SaveMICity.com provides Michigan residents with a wealth of information regarding their local communities and the issues at hand. Inquiring minds are able to see just how much the state has taken from their specific locales via a revenue-sharing database. Sharing this information online and spreading the news to family and friends will help get the word out. “Information is power. The more people understand the process, the more involved they can become. The more legislators understand the challenges at the local level, hopefully the more involved they can become, helping foster the changes at the state level that are needed,” Stubblefield explains.

On the organization’s site, SaveMICity supporters encourage residents to “ask your legislator to rethink budget priorities and stay engaged on the broader issue of reforming our system.” The more support is garnered for initiatives designed to invest in communities for sustainable change, the more likely these changes will be made. SaveMICity is also looking for community members to help host future events. “We are taking this approach to break away from the historically limiting tactic of incremental change within the context of where we are today. We need new ideas, innovative approaches, and bold action to create a new future for communities around Michigan,” the site explains.

Sheryl says the message will be a “a continuous conversation until local units can get some relief by way of tax reform.” “By employing community-based placemaking strategies, we strengthen both our economic and social future.”